Award-winning PDF software

Nc court s aoc-e-506 Form: What You Should Know

A Ministry Needs to Have the Authority to Make This Decision — The Bible The ministry needs to have the authority to make the decision whether to participate in Medicare/Social Security. If You Are a Minister, Your Job Is to Build an Advocate — Christian Medical & Dental If you are a minister or a lay preacher, and you are in the ministry for your ministry's sake and not for your job as a pastor or lay preacher, the following items may be important when you are thinking about filing Form 4361 with the IRS to opt out of Medicare/Social Security and pay your own share of the Social Security taxes: • The income you get from a ministry will be important • Who do you speak to about the issue to determine if you are a qualified minister • Who have you spoken to the other ministers? • Who are your primary sources of references when looking for clergy referrals or clergy to speak to about this issue? • What type of documentation are you going to need with the Form 4361 application? There are 2 Ways To Pay Self-Employment Taxes: You can contribute into an SSA (Social Security) plan using an Individual Retirement Account (IRA) or 401K. If you contribute in any one year (including a month or two before you retire), you will pay the 3.8% Social Security tax on the first 118,500 in income (plus taxes withheld on that first year's wages). If you contribute in one lump sum in each of the 4 upcoming years, and then you withdraw in retirement that amount plus any income you earned after withdrawing will be 1,008.20 in 2018. If you contribute in one lump sum and withdraw in retirement during your working life you will pay the 3.8% Social Security tax on that withdrawal. If you continue to contribute and withdraw in retirement you still will pay the Social Security tax on those withdrawals. If You Don't Contribute. You must pay the 5.3% Medicare tax, in addition to the 3.8% Social Security tax and the 2.9% Medicare taxes on self-employment earnings over 200,000. In the example above, your Social Security tax is 1,084.20 each year, so you would pay 26.18 to the Social Security Administration (1.084 × 60 × 12 = 1,824.20). You're remaining 2.9% Medicare tax would be 24.36. You're remaining 1.084% Social Security tax due is 12.14.

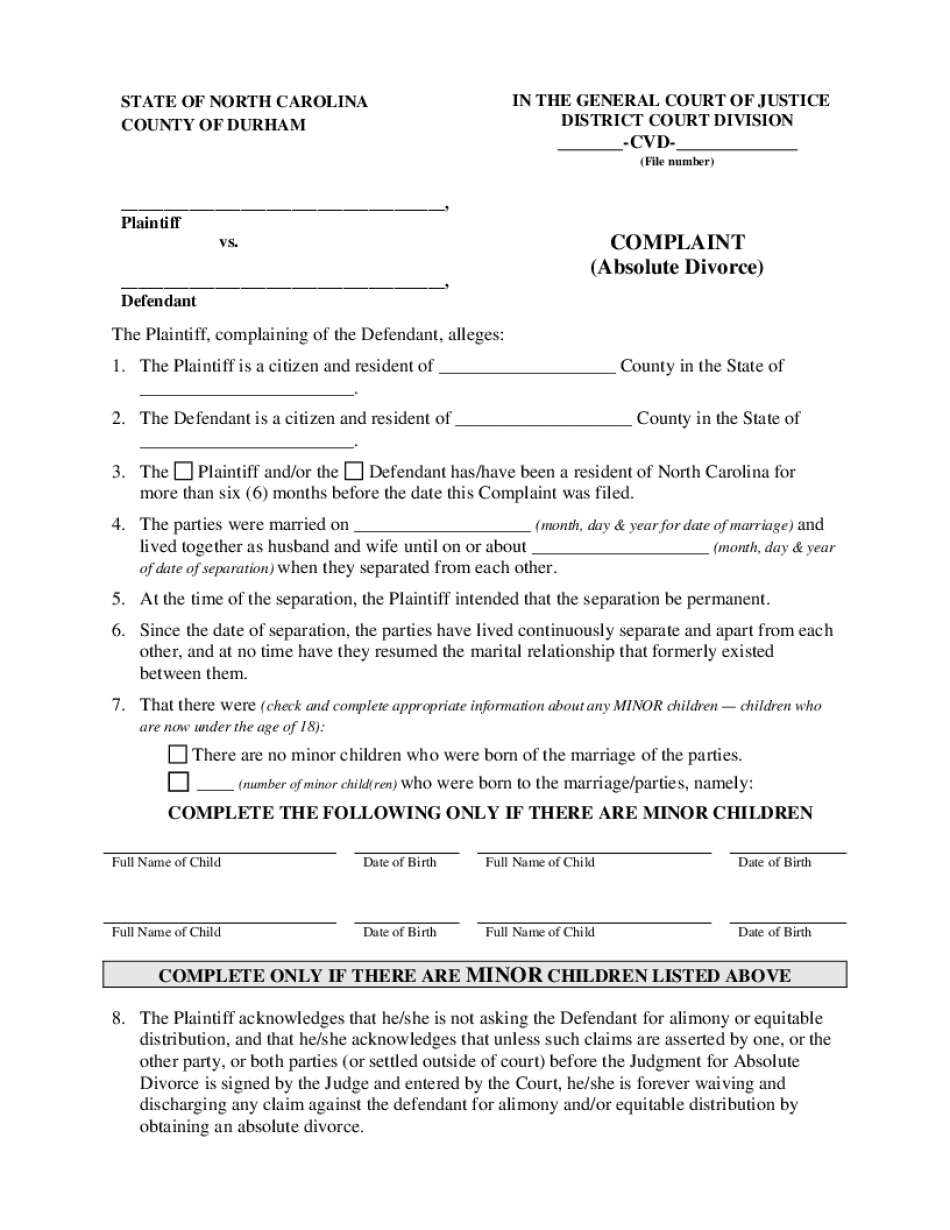

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do NC Court Form Complaint absolute Divorce, steer clear of blunders along with furnish it in a timely manner:

How to complete any NC Court Form Complaint absolute Divorce online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your NC Court Form Complaint absolute Divorce by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your NC Court Form Complaint absolute Divorce from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.