Getting a divorce in North Carolina is actually simpler than you might think. Either spouse must be a resident of North Carolina for at least six months before filing. Divorce may be filed in the county of residence of either spouse. Once the residency requirement is completed, a legal grounds for divorce must be established. Both general and no-fault divorce are acceptable grounds for divorce. No-fault reasons include living separate and apart without cohabitation for one year. The reasons for general divorce are confinement for incurable insanity for three years or incurable mental illness based on examination for three years. North Carolina does not require a parenting plan for child custody. Joint or sole custody is determined according to the interests and welfare of the child. There is no presumption that either parent is better suited to have custody. No other factors for consideration are specified in the statute. Both parents are responsible for the support of a child and either parent may be ordered to pay support. The factors considered are the needs of the child, the relative ability of the parents to support the childcare, and homemaker contributions of each parent, the assets of the child, and any other relevant factors. The official child support guidelines are presumed correct unless there is a showing that the amount of support would be unjust or inappropriate. Child support worksheets are also provided. Child support may be paid to the court clerk. Income withholding may be used if child support payments are overdue. Child support obligations may need to be secured by a bond or mortgage. Furthermore, the court may require a parent to provide health insurance coverage for the child. North Carolina is an equitable distribution state. Separate property includes any property acquired before the marriage, any gifts and inheritances acquired during...

Award-winning PDF software

Nc divorce s PDF Form: What You Should Know

This packet helps the Judge be sure that your spouse, the Defendant, is not in active service in the military, and so protected from civil lawsuits. Free Printable NC Divorce Papers and Forms Online Download free divorce forms in pd for order a personalized package to get a quick and simple divorce offline. Start Divorce Online for 139. Browse Divorce Packet for more divorce forms for NC and surrounding states. NEVADA DIVORCE PACKET This form helps the Judge be sure that your spouse, the Defendant, is not in active service in the military, and so protected from civil lawsuits. A. Fill in Nevada Divorce Package This packet provides information, steps, and forms for getting an absolute divorce. Free Printable Nevada Divorce Papers and Forms Online Download free divorce forms in pd for order a personalized package to get a quick and simple divorce online. Start Divorce Online for 139. Browse Divorce Packet for more divorce forms for New Hampshire and surrounding states. NEW JERSEY DIVORCE PACKET This packet provides information, steps, and forms for getting an absolute divorce. Free Printable New Jersey Divorce Papers and Forms Online Download free divorce forms in pd for order a personalized package to get a quick and simple divorce online. Start Divorce Online for 139. Browse Divorce Packet for more divorce forms for New Jersey. NEW MEXICO DIVORCE PACKET This form helps the Judge be sure that your spouse, the Defendant, is not in active service in the military, and so protected from civil lawsuits. A. Fill in New Mexico Divorce Packet This packet provides information, steps, and forms for getting an absolute divorce. Free Printable New Mexico Divorce Forms and Documents Online Download free NJ Divorce packets form for a personalized divorce for New Mexico. Start Divorce Online for 139. Browse Divorce Packet for more divorce forms for New Mexico. NEW YORK DIVORCE PACKET This form helps the Judge be sure that your spouse, the Defendant, is not in active service in the military, and so protected from civil lawsuits. Free Printable NY Divorce Papers and Forms Online Downloads free NY Divorce documents in pd for order a personalized divorce. Start Divorce Online for 139. Browse Divorce Packet for more divorce forms for New York City and surrounding states.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do NC Court Form Complaint absolute Divorce, steer clear of blunders along with furnish it in a timely manner:

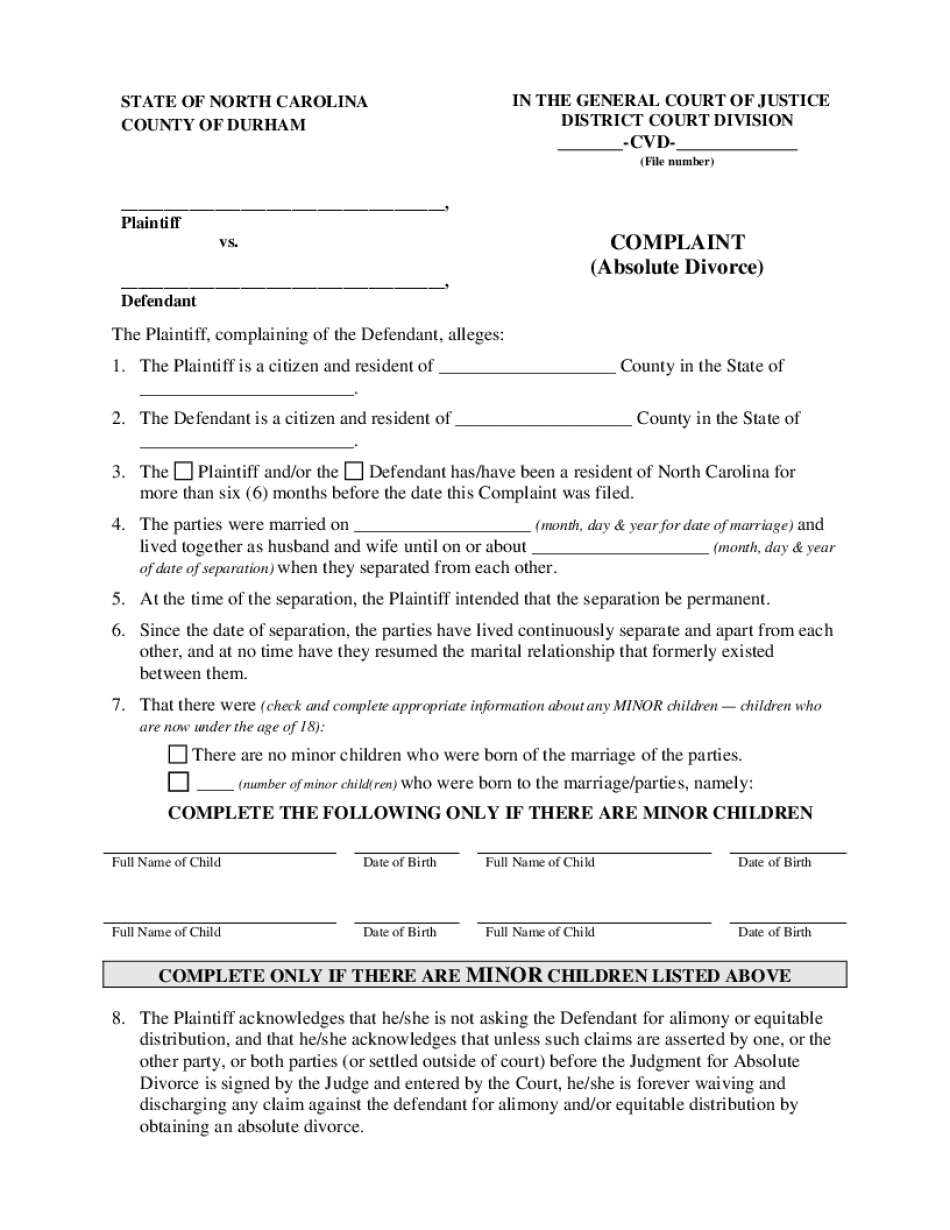

How to complete any NC Court Form Complaint absolute Divorce online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your NC Court Form Complaint absolute Divorce by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your NC Court Form Complaint absolute Divorce from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nc Divorce Forms PDF